2025 Multifamily Outlook: Why It’s a Vintage Year

- Investor Relations

- Nov 5, 2025

- 2 min read

The multifamily sector is entering one of the most compelling acquisition windows in over a decade. The 2025 multifamily outlook from CBRE and Freddie Mac points to a rare alignment of falling supply, stable fundamentals, and widening yield spreads — conditions that historically define a “vintage year” for disciplined investors.

1. Supply Has Peaked — And the Backlog Is Shrinking for the 2025 Multifamily Outlook

According to CBRE’s U.S. Real Estate Market Outlook 2025, national multifamily vacancy is projected to stabilize near 4.9%, with new starts expected to fall 74% below the 2021 peak and roughly 30% below pre-pandemic levels.

Freddie Mac’s 2025 Multifamily Outlook echoes that net deliveries are expected to decline by more than 40% YoY. Similar supply contractions in prior cycles preceded strong rent and occupancy recoveries.

2. Transaction Volume Rebounding at Lower Bases

MMCG Invest reports national multifamily transaction volume rose 18% in 2024 to roughly $102 billion, while Q1 2025 posted a 33% YoY increase.

Freddie Mac forecasts total multifamily loan originations between $370–380 billion in 2025, signaling liquidity normalization.

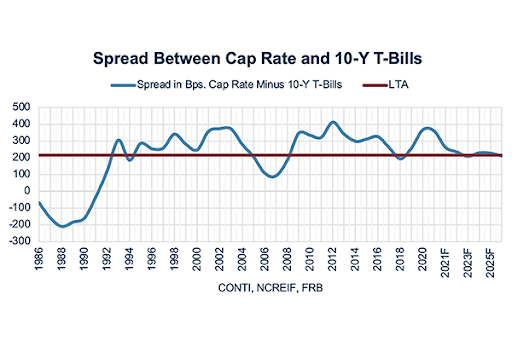

Cap rates remain 5.5–5.8%, roughly 120 bps above the 10-year Treasury, offering a historically favorable entry spread.

3. Fundamentals Remain Intact

Despite muted rent growth (+0.3% YoY per RealPage Analytics), long-term drivers remain strong:

Migration to the Southeast, Texas, and Mountain West.

Affordability gap — homeownership costs ≈ 2–3× rents (CBRE).

Demographics — Millennials & Gen Z driving demand; immigration sustaining workforce housing.

Supply moderation — Cushman & Wakefield Q3 2025 MarketBeat shows deliveries ↓ 27% YoY, rent growth resuming in key metros.

4. The Vintage Year Thesis

A “vintage year” occurs when pricing and fundamentals disconnect. The 2025 multifamily outlook meets every criterion:

Pricing: 15–25% below 2022 levels

Supply: Down > 40% YoY

Demand: Household formation + migration tailwinds

Debt: Stabilizing yet selective

Periods like 2009–2011 and 2020–2021 proved that deploying capital during dislocation captures outsized returns once fundamentals normalize.

Key Takeaways

Disciplined acquisitions now position investors ahead of recovery.

Market selection — target metros with peaked supply & strong employment.

Debt strategy — lock favorable terms before spread compression.

The next cycle rewards execution and operational alpha, not leverage.

Data & Visual Credits

CBRE | Freddie Mac | RealPage Analytics | Cushman & Wakefield | Yardi Matrix | Arbor Realty | MMCG Invest | CONTI Capital

Comments